City Council unanimously approved Evanston’s Fiscal Year 2024 budget at its Monday night meeting. The final budget totals about $435 million, down from the $449 million proposed in the initial budget.

When the budget was first introduced in October, it included a proposed 7.9% increase to the property tax rate, which drew concerns from many residents. Some councilmembers suggested that because the property tax rate has remained constant in Evanston for the past few years, the rate hike may be difficult for residents to keep up with.

The final budget doesn’t include any change to the property tax rate. Instead, the city decided to cut back on a few different expenditures, slashing Capital Improvement Program spending by nearly $14 million and leaving 4% of city staff positions vacant.

As city government works to make costs of living in Evanston more affordable, some councilmembers praised the decision to keep property taxes flat for another year.

“We are making the largest investment in affordable housing that this council has ever made on an annual basis, and at the same time … we’re keeping the property tax levy flat, really adding to affordability for housing here in our city,” Ald. Devon Reid (8th) said.

Other councilmembers raised concerns about the city’s fiscal future. The budget only includes about $414 million in revenues – amounting to a nearly $22 million deficit. Balancing this year’s budget will leave the General Fund with a $10.5 million deficit, which the city plans to offset by pulling from its reserves.

Several councilmembers pointed out that relying on the General Fund to balance the budget isn’t sustainable in the long term. The council agreed that the city needs to seek out new sources of revenue in order to balance future budgets.

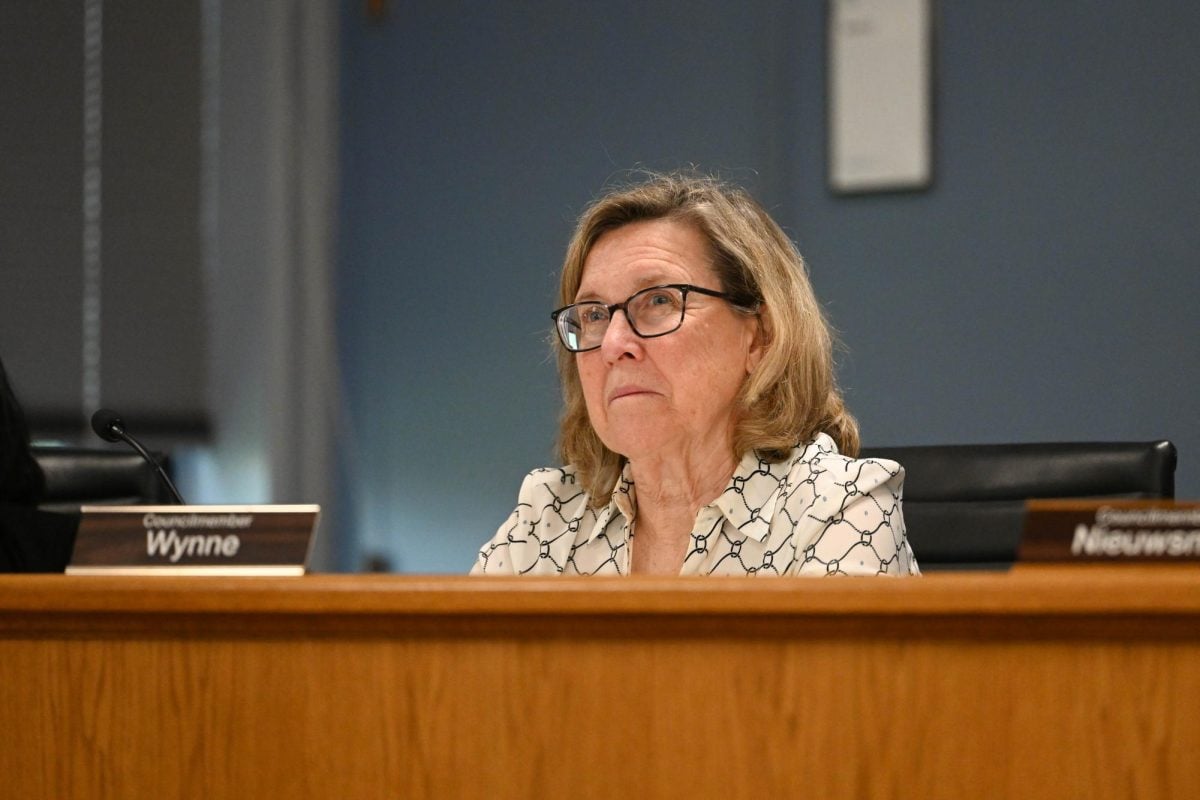

But, Alds. Jonathan Nieuwsma (4th), Melissa Wynne (3rd) and Eleanor Revelle (7th) argued that by keeping property taxes unchanged, the city could be setting itself up for even higher rates in the future.

“I don’t think we should attempt to get to zero on our property tax,” Nieuwsma said. “It’s a gimmick. It’s a stunt. I think in doing so, we just kind of cloak the fiscal reality that we’re confronted with.”

Nieuwsma added that he would rather incrementally increase property tax on an annual basis, rather than keeping it flat and later taking “one big giant step.”

In a presentation to councilmembers, city treasurer Hitesh Desai pointed out that the General Fund deficit is projected to increase in the coming years. If current budget patterns continue, the General Fund could dip below its minimum threshold of 16.6% of the city’s annual budget value by 2026, Desai said. And, with federal pandemic emergency funding from the American Rescue Plan Act set to run out soon, the city could be left without a key source of its recent revenue.

Ald. Clare Kelly (1st) pushed back on some of these projections. While she said that the city needs to focus on “better budget policy,” she also said that the city’s projected revenues are realistic and will help to offset the deficit.

“Just to raise (property taxes) because it’s not sustainable, that’s presupposing those graphs, that’s presupposing budgets into the future that we haven’t even agreed on,” she said. “I ask everybody to exercise sensitivity and awareness of our residents, and to hold the levy flat this year.”

Email: [email protected]

Twitter: @lilylcarey

Related Stories:

— The Daily Explains: What’s in Evanston’s proposed 2024 budget?

— City Council discusses lead pipe replacement, proposed water rate increase

— Residents voice concerns on property tax hikes at City Council ‘Truth in Taxation’ Hearing