The deadline to register for health insurance under the Affordable Care Act is Jan. 15. Here’s what to know before signing up.

January 7, 2022

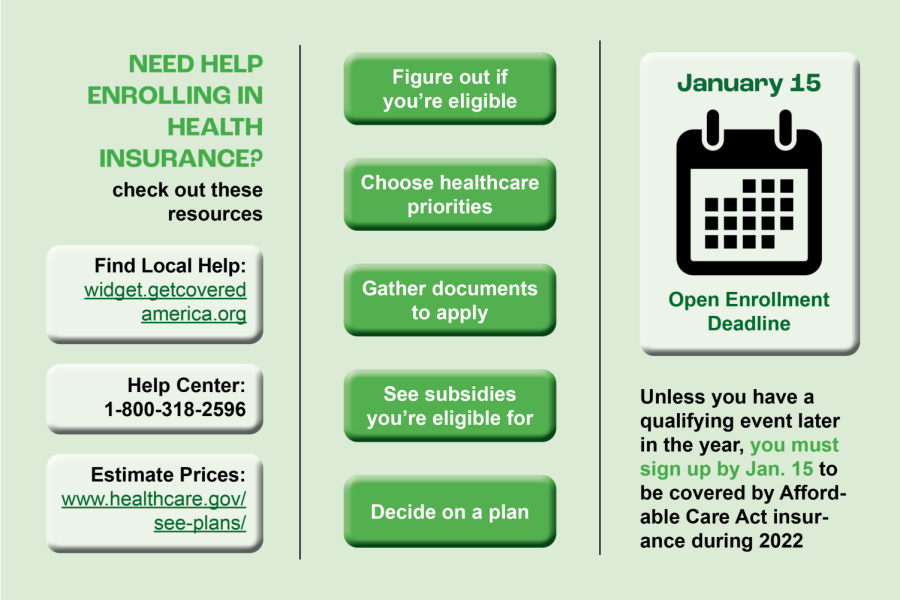

The open enrollment deadline for the Affordable Care Act is Jan. 15. To sign up for health insurance under the ACA — the cheapest way to get health insurance for many — you must register by Jan. 15. If you do, insurance coverage will begin Feb. 1.

Information about insurance can be overwhelming and confusing. Here’s what you need to know in order to sign up.

Am I eligible?

Various eligibility criteria and exclusions apply. To be eligible, you must be currently living in the U.S. Additionally, you must be a U.S. citizen, U.S. national or be lawfully present in the U.S.

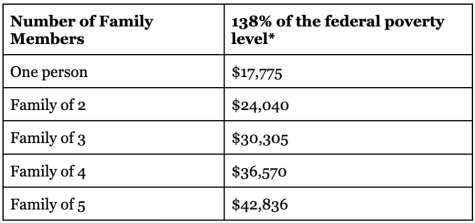

If you make less than 138% of the federal poverty level, you’re eligible for Medicaid, which has no enrollment deadline. Other eligibility criteria for Medicaid also apply to some.

‘

*According to HealthCare.gov

Individuals ages 65 and older are eligible for Medicare instead of insurance under the ACA.

Incarcerated people are not eligible for ACA insurance. Upon release from incarceration, however, you can sign up for insurance under the ACA regardless of the enrollment deadline.

If your job or your spouse’s job offers health insurance, you may not be eligible for subsidized ACA insurance.

While undocumented immigrants are not eligible for insurance under the ACA, Illinois offers options for those ages 65 and older or under 18. DuPage Health Coalition provides assistance as well.

How should I choose a plan?

Plans are split into four tiers: bronze, silver, gold and platinum. Bronze plans have the lowest monthly payment, known as a premium, but the highest costs for medical care. Platinum plans have the highest monthly premium, but the lowest costs for care.

The best plan for you varies based on the care you want, the amount of care you expect to use and the premium price you’re able to pay.

You’ll buy your health insurance plan on Health Insurance Marketplace, a platform which shows you potential plans.

How much will my plan cost?

The cost of your health insurance plan depends on several factors, like income, number of family members and dependents, the zip code you live in and the plan you choose.

Marketplace offers two types of subsidies: premium tax credits and cost-sharing reductions.

Premium tax credits lower the amount you pay monthly; cost-sharing reductions lower the amount you pay for medical care. If you qualify for cost-sharing reductions, keep in mind they only apply to silver plans.

Patients with preexisting conditions should not receive different treatment, according to Nelson Socarras, who manages the benefits navigation team of Howard Brown Health, a Chicago-based LGBTQ+ organization.

“Insurance from the Marketplace will never ask you anything about preexisting conditions,” Socarras said. “Absolutely not.”

To estimate how much Marketplace health insurance will cost for you, you can enter personal information into this HealthCare.gov tool (also available in Spanish).

What will my plan cover?

All Marketplace plans cover these central benefits:

— Outpatient care

— Emergency services

— Hospitalization

— Pregnancy and maternity

— Mental health and substance use disorder services

— Prescription drugs

— Rehabilitative and habilitative services and devices

— Lab services

— Preventative services and chronic disease management

— Pediatric services

— Birth control

— Breastfeeding

Other benefits, like dental and vision coverage, vary by plan. You can look for plans that include them or buy separate dental and vision plans.

Illinois offers some protections against insurance discrimination for transgender people. Transition-related care, however, may not be covered by all plans.

Audrey Carter, the resources coordinator at Hamdard Health Alliance in Rogers Park, recommends creating a list of your top health priorities to keep in mind when selecting a plan.

How do I sign up?

If you haven’t enrolled in Marketplace insurance before, go to HealthCare.gov and make an account. If you have an account, log in.

From there, select your state and click “Start my application.” You’ll need to enter information about your family and income. For immigrants, the application often asks for information about how long you’ve been in the U.S. and your immigration status.

To see the documents you’ll need on hand, look at this list.

Can I register after the deadline?

In most cases, no. But if you experience a qualifying event, you may become eligible.

Qualifying events include some changes in your household — like getting married, having a baby or adopting a child — loss of healthcare, release from incarceration and changes in residence.

See more information on qualifying events here.

How do I maintain my insurance?

You must make an initial monthly payment by Jan. 31 for insurance to be activated. If you don’t, you won’t be insured for the year.

After the initial payment, you typically have 90 days to catch up on payments you’re behind on.

Throughout the year, you must update Marketplace if your financial, family or living situation changes. This is critical because the subsidies you receive are dependent on this information. If you get more subsidies than your actual income entitles you to, you’ll need to pay back the amount when you pay taxes.

Where can I learn more?

FAQs about Marketplace health insurance are available here. If you have more questions, you can call HealthCare.gov’s help center at 1-800-318-2596 (TTY: 1-855-889-4325).

The Illinois Department of Insurance’s Health Insurance Glossary offers a list of insurance-related terms and definitions.

If you need help specific to you, whether that’s deciding on a plan or navigating the application, this online tool allows you to search for free help near you.

Email: [email protected]

Twitter: @avivabechky

Related Stories:

— Changes to student health insurance include premium hike, prescription drug benefits

— Amendments to health insurance plan will return costs for mental health treatment to a lower price