Socially responsible investment committee hopes to create transparency, expand community access

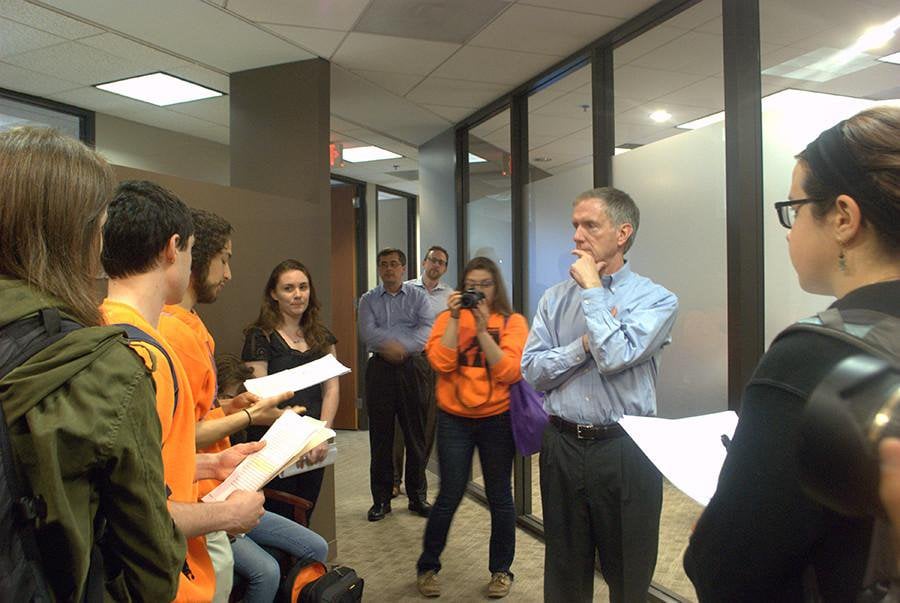

Daily file photo by Sylvana Caruso

Members of Fossil Free NU read a statement to chief investment officer Will McLean in 2015. The University recently created a socially responsible investment committee to improve communication with the Board of Trustees.

July 6, 2017

At its introductory meeting in May, Northwestern’s socially responsible investment committee took its first steps toward becoming a structured avenue for the community to reach the Board of Trustees regarding the University’s endowment, establishing general administrative procedures to increase transparency and access to investment decisions.

The Advisory Committee on Investment Responsibility — made up of students, faculty, staff and alumni elected by their respective peers — will consider proposals the community submits regarding NU’s investment activities and, after assessing them based on a set of criteria agreed upon by committee members, make recommendations to the Board’s own investment committee.

Because student divestment groups have expressed frustration while trying to reach the Board of Trustees and understanding its decisions in the past, McCormick graduate student and committee member Alex Ardagh said the ACIR will prioritize transparency.

“Before something like this, there was no obvious avenue for how the Board was accountable to students,” Ardagh said. “We know we want to have a clear process. We don’t want to unfairly screen people out or be a roadblock to accessing the board.”

Members are creating a website that will include instructions for submitting a proposal, information on the committee’s guiding principles and links to investment committees at other universities, said Kellogg Prof. and ACIR chair Ravi Jagannathan.

In addition, Jagannathan said members decided to hold open meetings once every quarter, with the first one taking place in September. They will present reports on the proposals they have looked into and invite the public to weigh in before making an official recommendation to the trustees.

“We need to establish a lot of things because this is the first time we are doing this,” Jagannathan said. “We want to do it right, thoughtfully, so that it can stand for a very long time and serve the purpose of the community as a whole.”

The ACIR — spearheaded by University President Morton Schapiro and chief investment officer Will McLean — was officially chartered in the 2016-17 academic year after almost three years of pushback from Fossil Free NU, Students for Justice in Palestine and Unshackle NU.

The student groups, along with other community members, were unhappy with the lack of a direct avenue to the Board of Trustees and demanded the establishment of an ACIR committee to pass along proposals, student committee members said.

“As opposed to how students could approach administration members, like Morton Schapiro, the Board of Trustees is seen as even beyond the administration, as basically unapproachable or unassailable,” said Ardagh, who was formerly a member of Fossil Free NU.

Much of the first committee meeting was dedicated toward setting up the ACIR’s general operation.

Although the committee doesn’t have a set agenda, members anticipate the three student divestment groups will each submit proposals. Shane Patel, a McCormick graduate student and committee member who is also involved with Fossil Free NU, said the organization intends to submit one in the coming year.

However, Patel said even if a proposal does pass the committee’s assessment criteria — which have yet to be created — the ACIR still has to convince the Board’s investment committee of the idea.

“The main challenge the ACIR faces is being taken seriously by the Board of Trustees,” Patel said. “The ACIR is a recommending body so even if we endorse a resolution, the Board doesn’t really have to agree with what we say. They don’t have to implement any of our policies.”

Still, committee members said the set of criteria they come up with to screen submissions will be crucial for guiding meaningful discussion and ensuring the strongest possible proposals are taken to and considered by the Board. The committee plans to finalize these standards by its next internal meeting in August.

Email: [email protected]

Twitter: @rdugyala822