The state’s newly formed Invest Illinois Venture Fund’s first investments will allocate $575,000 to two Chicago area startups, one founded by a Northwestern alumnus and another by an NU professor.

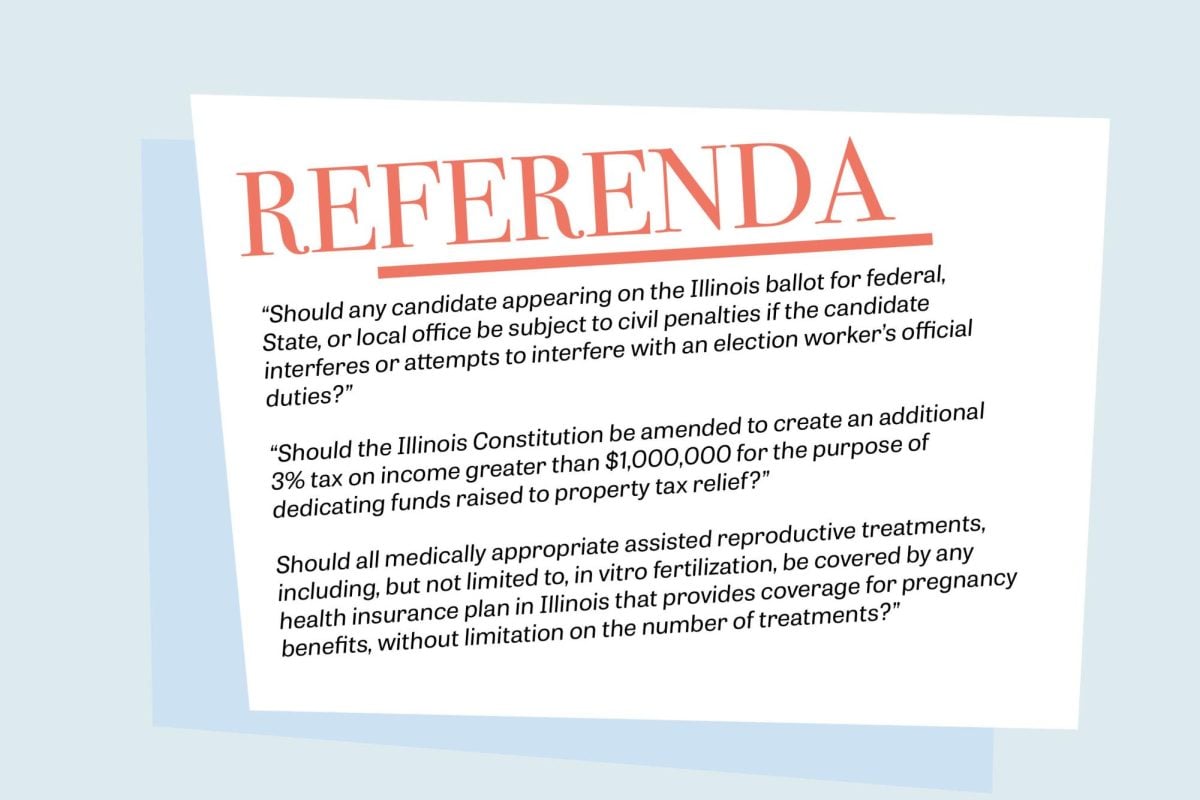

The Invest Illinois Venture Fund is part of a $78 million Advantage Illinois program, which was created last October to encourage investment in small businesses and to apportion venture capital to startups. Companies that receive state venture capital are typically up-and-coming, innovative and timely businesses with the potential for creating jobs. In order to qualify, companies must also have acquired private investors.

Both Chicago-based Buzz Referrals and Evanston AuraSense Therapeutics are developing businesses that were founded in 2011.

Buzz Referrals is behind an online social media platform that helps local businesses network with their customers through recommendations. Its CEO, Jordan Linville (Kellogg ’08), launched Buzz Referrals with the help of Excelerate Labs, a Chicago incubator. He said the state selected his company to be a beneficiary of the Invest Illinois Venture Fund because of its cutting-edge technology.

“We’re doing really exciting things with referral marketing within the context of social media,” Linville said. “With the state’s involvement, they really think about us growing, experiencing jobs and capital that normally would go to San Francisco or Boston or New York. We have to keep them here at home.”

Chad A. Mirkin, an NU chemistry professor, created AuraSense Therapeutics, a biotechnology company dedicated to exploring spherical nucleic acid constructs, which Mirkin invented in his lab.

SNA constructs have the potential to work as therapeutics against numerous illnesses such as heart disease and cancer, according to the business’s website.

One of AuraSense Therapeutics’ investors, Abbott Biotech Ventures, is dedicated to investing in emerging biotech and pharmaceutical companies.

Adelle Infante, Abbott external communications representative, wrote in an email to the daily that AuraSense Therapeutics technology complements Abbott’s key research areas, such as oncology and neuroscience.

“(Abbott Biotech Ventures) invests in technologies that are strategic to Abbott…as well as emerging or more opportunistic areas of innovations that have the potential to complement Abbott’s existing portfolio or to expand Abbott’s future business reach,” Infante wrote.

In addition to private funding, state funding can make a significant difference in helping small, developing business succeed, stimulating the economy in turn, said Troy Henikoff, CEO of Excelerate Labs.

Illinois Gov. Pat Quinn said at Excelerate Labs on Tuesday he was confident the investments will be successful.

“This new venture fund is allowing us to help small and startup businesses increase innovation and competition, expand and create good-paying jobs,” Quinn said Tuesday.