The City of Evanston made small strides in addressing its current pension funding shortfall, according to the 2011 pension valuation report.

Last month, the city’s actuary determined that the police and firefighters’ pension funds increased an estimated 5 percent from last year. Evanston currently owes $275.2 million.

Currently, Evanston funds less than 50 percent of pensions. New state law mandates that 90 percent of pension funds should be funded by 2040. It was pushed back from the original goal of 2033.

Ald. Donald Wilson (4th) called the increase in funds “baby steps.”

“They’re baby steps, but they’re still steps forward,” Wilson said. “So as long as we continue to take steps forward, we’ll continue to increase that percentage number.”

The 5-percent increase in pension funds can be attributed to a few steps the City took in the last year to alleviate the crisis. Evanston hired a new actuarial firm, Tepfer Consulting Group, Ltd. and made changes in budget proposals to allocate more money into the pension funds.

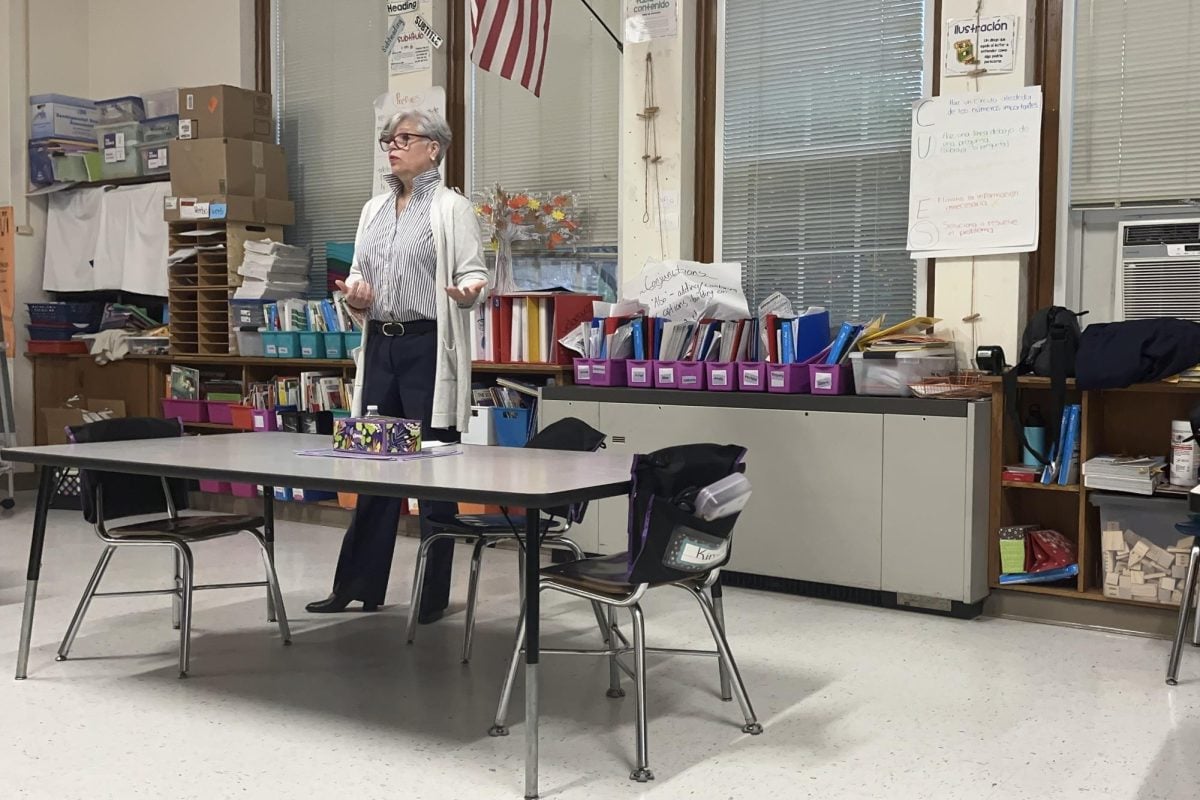

New actuary

Earlier this year, the City decided to hire a new actuarial company to evaluate the pension fund.

The City’s actuary is responsible for recommending how much the City should pay to the pension fund in contributions, based on a set of assumptions including the rate of investment returns, salary increases, mortality and retirement.

In the past 30 years as pensions became increasingly underfunded, the actuarial assumptions used by the City to decide its contributions did not call for as much contributions as needed in order to avoid the current crisis.

The City’s former actuarial firm Gabriel Roeder Smith & Company, which was hired in 2007, made more conservative assumptions, making the unfunded percentage of the fund seem greater than in previous years.

Currently, Tepfer Consulting Group, Ltd. is continuing to make assumptions that tend to be on the conservative side.

The city chose to switch actuaries in 2011 because although GRS is a nationally renowned actuarial firm, Tepfer has many more clients in the Downstate Illinois pension system of which Evanston is a part, Assistant City Manager Marty Lyons said. Arthur Tepfer, principal and actuary of the new consulting group, also charges $15,000 for their actuarial studies, as opposed to GRS’s $40,000.

Increasing contributions

Before Evanston can start funding for the future, it needs to catch up on its present and past debts.

Evanston’s current strategy, which was adopted over the course of the last four or five years, is to increase contributions in order to offset low investment returns from under-performing stocks. City officials consider this a necessary step in making headway on decreasing the unfunded liability.

The general equation of pension funding is: “contributions + investment return = benefits,” Tepfer said.

According to Tepfer’s valuation report released at the Oct. 24 city council meeting, the police and firefighters’ funds are currently estimated to be 45.7 percent and 45.6 percent funded, respectively, which makes for a 4.2-percent and 5.4-percent increase from the original contribution projection for the year.

Because Tepfer and GRS both err on the side of conservative actuarial assumptions, this approximately 5-percent increase indicates a realistic gain in funds.

Still, the combined police and fire pension fund remains less than 50 percent accounted for. Pensions are 45.6 percent funded overall, according to the city’s estimation system. However, that system of estimation is a more conservative one than the state legislature’s proposed system. If Evanston were to estimate its pension fund according to the state system of minimum contributions, the fund would appear to be 47.97 percent funded.

This discrepancy speaks to the City’s strategy to remedy Evanston’s pension crisis by increasing contributions to the fund. Lyons said the City purposely adopted the model which makes the fund look a little worse in order to be more fiscally conservative in its suggested contributions.

“We’re on the conservative end of investment return (estimations), so we’ll see if that is enough to help us catch up,” Lyons said. “I think what’s really important though is that the City is now funding at a level where we are in compliance and then some with state requirements.”

Wilson said although he wouldn’t say he is confident in the City’s strategy to make more contributions in the short term despite its tight budget, he said he believes the City has a responsibility to fund pensions.

“It’s necessary to increase the funding because if you don’t, you don’t want to end up looking like the state (Illinois) looks,” he said. “They chose not to fund at the level they should have been funding. If you look back historically, I think Evanston followed what was recommended … it’s just a question of those recommendations not meeting what the needs wound up being.”

Cause of the crisis

Evanston’s pension shortfalls have been approximately 30 years in the making.

Northwestern’s Kellogg School of Management professor Joshua Rauh volunteered to present his views on Evanston’s pension funds to the city council at its Sept. 13, 2010 meeting.

“I found that based on today’s levels of service and salary (that is, if all plans were frozen today, which they are not), the funding gap for Evanston would be around $300 million, or $10,000 per household,” he wrote in an email to The Daily.

Evanston’s unfunded liability has gradually increased over the years. In 1997, the unfunded liability for both police and firefighters was $48.2 million, compared to this year’s liability of $149.7 million, according to the valuation report by Tepfer. There are several reasons for this, according to the Blue Ribbon Committee report, written in 2008 by independent and “interested Evanston citizens” appointed by the City Council to explore the causes behind the crisis and suggest solutions.

Lyons said the bulk of the growth of the pension fund should ideally come from investments and not new contributions.

“The city presently, in the last four years, is not struggling with the contribution part,” he said. “We do what the actuary says … You need to take a 30-year view of any pension discussion. In the last decade, funds have been under-performing what the assumptions are. If you talk to any actuary, they will say that doesn’t make the assumptions wrong. Assumptions are meant to be reality over a 30-year term.”

Suggested solutions

Evanston’s current strategy for decreasing the underfunded liability is to contribute as much as possible in the short-term to compensate for a projected 7 percent investment return rate and to ensure debts do not accrue.

The Blue Ribbon Committee recommended that the city explore several options for increasing revenue including asset sales, revenue enhancements, budget cuts and program efficiency changes. It also suggested raising taxes as a last resort.

However, some city officials believe that in light of having considered all of the options, the city’s contributions must derive from taxes or budget cuts.

“(Additional funds) come from the taxes, really,” Wilson said. “You’re going to have to pay taxes or you make cuts to other areas of the budget and you conserve money, but at the end of the day it’s going to go one of two ways. We either charge people for things or we collect taxes.”

The city’s 2012 budget proposal suggested a nearly 8 percent property tax increase. About 5 percent of that increase will go to non-general funds including police and fire pensions.

There has also been talk of possibly switching police and fire pensions from defined benefit plans to defined contribution plans.

Under a defined benefit plan, benefits are guaranteed to the employee upon completion of service. Under a defined contribution plan, only contributions by the employer — in this case the city — are guaranteed. Under this plan, if investments perform poorly, the employer is not liable for compensation.

Lyons said the defined contribution plan would be the preferred choice when the stock market is performing well.

The Blue Ribbon Committee report recommended the change to the defined contribution plan which would be more consistent with the private sector, but Lyons said it is unlikely to make headway.

“Illinois has very strong labor unions for police and fire so no legislation on the defined contribution plan has reached either senate or house floor,” Lyons said.

Timothy Schoolmaster, a member of the police pension board, said the police and fire pension boards don’t think it’s a good idea for people working in “especially hazardous, rigorous occupations” without parallels to those in the private sector to change to the defined contribution plan.

The future of the fund

Despite the underfunded status of the pension, Evanston’s actuary, city officials and representatives of the independent police pension board all agree the city is headed in the right direction.

Tepfer said compared to many municipalities in the state, he is not overly concerned about Evanston’s pension funds situation.

“I think it’s improving. I think they have had some difficulties many years ago, but they seem to have come out of it,” he said. “They’re now on a strong path. They’re meeting their goals. They have a strong management philosophy in the city and they have been funding at a very different level than they used to. The new city management has taken this bull by the horns and done very well with it.”

In comparison to Chicago’s pension fund and that of the state, Evanston remains in “much better shape,” Rauh wrote in an e-mail.

“In Chicago the pension debt per household is $42,000,” he wrote. “Evanston has stepped up the funding of its pension systems in percentage terms by much more than Chicago. If they keep that up, they can postpone a wholesale collapse of the system. If Evanston gains taxpaying residents from Chicago who are dissatisfied with the situation there, that would also help our net position.”

Schoolmaster emphasized that Evanston still remains far ahead of the state in terms of funding its pension.

“Evanston is certainly not like the state of Illinois, which you know is No. 1 in the country and I don’t mean at the top,” he said.