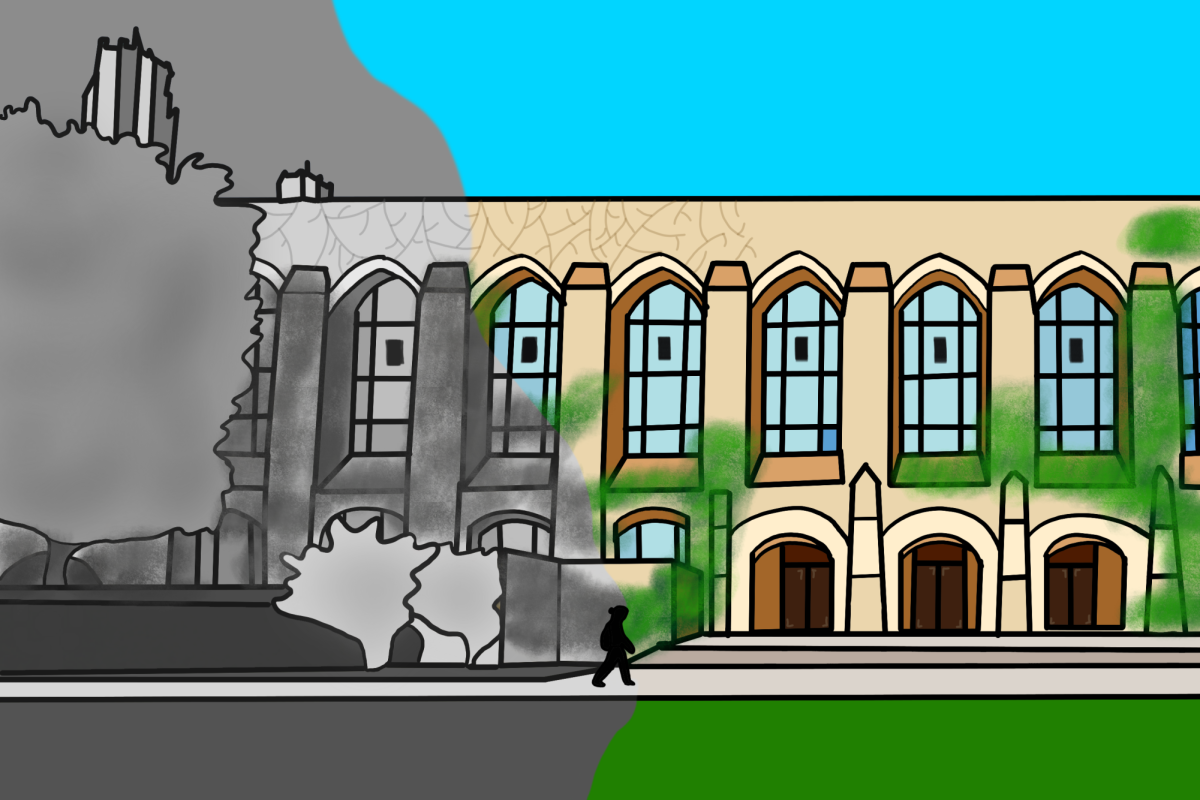

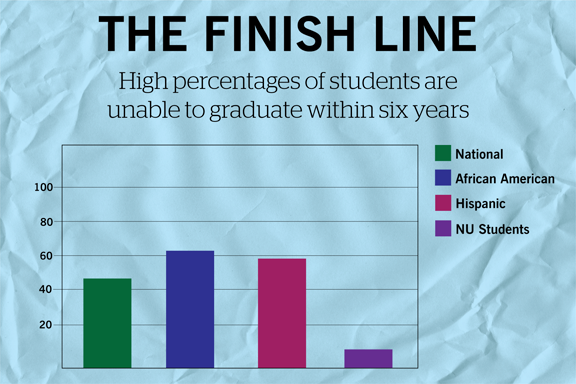

Although new reports show nearly half of students currently enrolled in college in the United States will not graduate within six years, enrollment numbers from the past several years show that Northwestern defies the national average.

Released late last month, the American Dream 2.0 report examines how financial aid affects students’ access to college education, finding that 46 percent of current college students will not graduate within six years. The dropout rates are even higher for minorities, with 58 percent of Hispanics and 63 percent of blacks failing to graduate within six years.

The report recommends three specific goals for financial aid reform: simplify the financial aid system, embrace innovations serving students and urge institutions, states and students to share responsibility for producing more graduates without compromising access and affordability to education.

“Our coalition believes smarter, more efficient and more effective financial aid investments will strengthen our country and improve millions of lives,” the report states.

NU’s graduation rates are nearly double the national average, with about 85 percent of students graduating within four years and 93 percent within six years. Michael Mills, associate provost for University enrollment, said steady enrollment rates during the last few years makes NU an exception to the graduation trend in the U.S.

“Enrollment has not been affected by the recent economic downturn, but we recognize how lucky we are,” Mills said.

Although enrollment remains unchanged, NU has been working to meet the increasing demand for financial aid for current and prospective students in order to maintain high graduation rates. In 2010, NU spent $94 million on financial aid scholarships. In 2011, the number jumped to $106 million, and last year the University spent $119 million, Mills said. Nearly 45 percent of students receive NU scholarship money.

“The recession hit many families of current students, which has increased the number of enrolled students who are now applying for aid for the first time,” Mills said.

Medill sophomore Zoe Brockman said the aid she received with her admission to NU played a big role when she was choosing which college to attend.

“The aid package helped me out a lot,” said Brockman. “I wouldn’t have been able to attend Northwestern without it.”

Coalition partner Terrell Halaska, a partner of the consulting group representing the report, said the team hopes the findings will spark a national conversation on access to college and access to financial aid.

“The coalition believes that if the challenges raised in this report are addressed, it will help more students succeed,” Halaska wrote in an email to The Daily. “Students must lead the charge for real change.”

Halaska and Mills both trace the increased need for financial aid to the recent economic recession.

Although family income has declined, college tuition costs continue to reach record highs, leaving many students struggling to pay for their education. The New York Federal Reserve reports a record-high $956 billion in outstanding student loan debt. The American Dream report suggests the mix of higher debt and lower graduation rates poses a threat to the nation’s economy.

“Through a more effective financial aid system, we have an enormous opportunity to strengthen our country and improve millions of lives,” the report concluded.

As the national debate on college accessibility continues, NU administrators are looking at the current system and how it can be improved.

“We’ve had to spend a lot more to meet the increasing demand,” Mills said. “Undergraduate financial aid is a top fundraising goal for us, and we continue to look at ways of improving the aid we provide to students.”