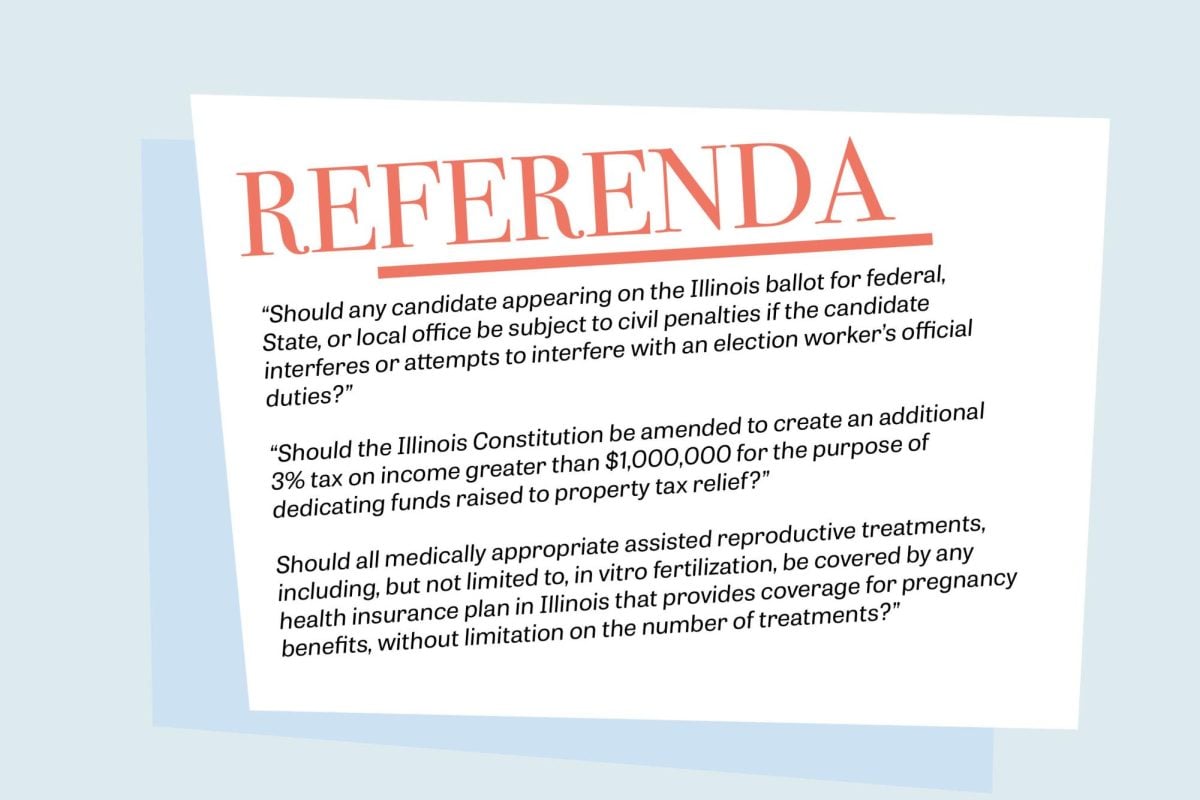

Illinois voters who have yet to cast their ballots have a week to decide how they plan to advise the state legislature on three referendums about election interference, a tax increase and IVF.

The ballot measures are advisory questions, meaning they are non-binding and the outcomes have no legal effect. They allow legislators to gauge the current thoughts of voters on various subjects, which could inform their decisions in the future, according to Illinois Policy.

“The advisory referendums on this year’s ballot deal with what I believe are some of the major topics at the top of the minds of voters and the general public,” said State Rep. Jay Hoffman (D-Swansea), who co-sponsored the bill the questions were proposed in, Senate Bill 2412, along with State Sen. Don Harmon (D-Oak Park). The bill passed in May this year.

The bill incited some backlash among prominent voter enfranchisement organizations, including League of Women Voters of Illinois. This was due to a proposed amendment to the Illinois Election Code that would block political party committees from putting candidates on the general election ballot if they did not go through the primary process, which was passed extremely quickly. None of the three referendums concern that change.

If any of these referendums overwhelmingly pass, the General Assembly may consider them in spring legislative session, Hoffman said.

Election Worker Protection and Candidate Accountability Referendum Act

The first referendum question asks, “Should any candidate appearing on the Illinois ballot for federal, State, or local office be subject to civil penalties if the candidate interferes or attempts to interfere with an election worker’s official duties?”

A “yes” vote on this question would advise officials to subject any candidate on the ballot, or individuals acting on behalf of candidates, to civil penalties if they interfere with election workers’ duties.

Several states, including New York and Pennsylvania, have enacted anti-election interference laws in anticipation of the upcoming election. This referendum could lead the state legislature to add Illinois to that list in the future.

“We’ve all read some horrendous newspaper accounts and accounts of election workers being threatened, being harmed,” Hoffman said. “A lot of times these are simply volunteers who are helping to provide a fair and impartial election process.”

Elizabeth Grossman, executive director of Common Cause Illinois, an election protection nonprofit, said specifically mentioning candidates was an interesting addition. She said that this referendum might be anticipating future election interference.

“You don’t want to be reactive,” Grossman said. “It has the same goal of just making sure our election workers are able to safely go about their duties and make sure that our elections are free and safe and fair.”

According to the Brennan Center for Justice, more than 90% of local election officials have worked to increase election security since 2020.

Property Tax Relief and Fairness Referendum Act

The second referendum question asks, “Should the Illinois Constitution be amended to create an additional 3% tax on income greater than $1,000,000 for the purpose of dedicating funds raised to property tax relief?”

A “yes” vote would advise state officials to amend the Illinois Constitution to raise the income tax.

“The property tax burden seems to be increasing,” Hoffman said. “So the question really is, how can you address that?”

Supported by former Gov. Pat Quinn, this referendum would amend the Illinois Constitution to create an additional 3% income tax on income greater than $1 million, dedicating those extra funds to property tax relief.

In 2022 data collected from the Civic Federation, Illinois had the second highest effective rate on owner-occupied property, trailing behind New Jersey.

“Right now, there are tax breaks for millionaires and tax bills, high property tax bills for everyday people,” Quinn said at the Capitol on Oct. 9. “That’s not a fair system.”

If a law is passed according to the recommendation, the state could generate $4.5 billion in revenue, according to the Illinois Department of Revenue. Owner-occupied properties would get property tax relief in the form of rebates if a law is passed.

Assisted Reproductive Health Referendum Act

The third referendum question asks, “Should all medically appropriate assisted reproductive treatments, including, but not limited to, in vitro fertilization, be covered by any health insurance plan in Illinois that provides coverage for pregnancy benefits, without limitation on the number of treatments?”

A “yes” vote would support advising officials to include any medically assisted reproductive treatment, which includes in-vitro fertilization, to be covered by health insurance plans that already provide full pregnancy benefits.

Currently, group insurance plans and health maintenance organizations in Illinois already cover IVF.

While Illinois already requires group health plans to cover fertility benefits, the referendum asks if individual health plans should be required to fully cover the treatments without copay. It also specifies that IVF would be covered no matter the number of times it is needed to be effective, Hoffman said.

Hoffman believes that a law supporting this referendum could apply to “short-term health plans,” and the health insurance exchange.

Email: shreyasrinivasan2026@u.northwestern.edu

X: @shreyasrin

Email: naomitaxay2027@u.northwestern.edu

X: @NaomiTaxay

Related Stories:

— Political misinformation can decrease voter turnout in local elections, local experts warn

— The Daily Explains: Who’s on the ballot for Evanston voters?

— ETHS students visit polls for November election, stress importance of voting