With triplets entering college at the same time, Jaida Hill’s parents were thrilled when she won an outside four-year, $80,000 scholarship just before graduating high school in 2021.

Though NU had already offered Hill about $50,000 in financial aid for each academic year, her family hoped the external scholarship could offset $20,000 a year in additional costs.

But when payments began in August, Hill’s family discovered the University had cut $20,000 from her yearly need-based aid — the equivalent to the outside award — only a month before she was set to start her freshman year.

“We were like, ‘Well, what’s the point of having a scholarship if it doesn’t actually mean anything?’” Hill, now a Communication junior, said.

Hill is one of many college students — at NU and other private and public universities — to have their financial aid reduced after winning outside scholarships.

This practice is sometimes referred to as scholarship displacement, which affects about half of U.S. scholarship winners, according to a 2021 survey by student discount servicer Student Beans.

Winning an outside scholarship can change the amount of money that schools expect a student’s family to contribute toward attendance. The student’s effective need, based on their family’s expected contribution, also changes.

But these determinations of need aren’t necessarily comprehensive for many students — including several at NU — who say their determined need isn’t the same as their family’s real need. For many students, their goal in pursuing outside scholarships is to bridge the distance between what the University determines their families can pay and what they actually can.

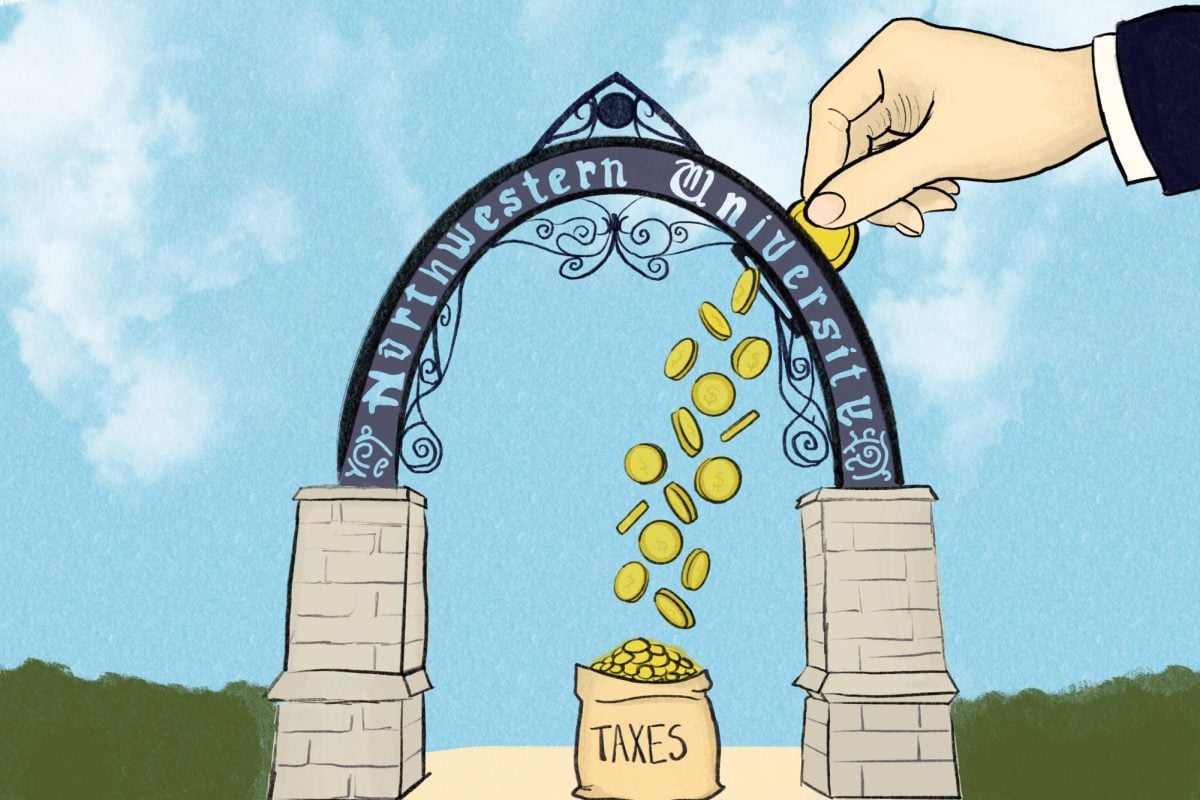

All universities, including NU, are bound by federal regulations when determining financial need if federal dollars comprise part of a student aid package. But for allocating institutional grants, some universities have crafted policies to allow students to retain part of their outside scholarships, while NU typically does not.

Despite many students winning outside scholarships up into the tens of thousands of dollars, NU’s practices have left some scrambling to keep pace with rising tuition costs. In trying to offset these costs, students who’ve just won outside scholarships are still sometimes left juggling jobs on top of full course loads.

What is ‘Scholarship displacement’?

According to the National Scholarship Providers Association, scholarship displacement occurs when one form of student financial aid, like a private scholarship, replaces or reduces another form of student financial aid, such as grants, work-study or loans.

Scholarship displacement typically occurs when an institution deems a student to be over-awarded, meaning the student’s total aid exceeds their total demonstrated financial need.

According to NU’s website for undergraduate admissions, financial aid awards from the University can include a combination of student loans, employment through a federal work-study program, a need-based scholarship from NU and federal or state grants.

The federal component of financial aid package awards are bound by federal guidelines for determining need. These determinations are based on personal data obtained through the Free Application for Federal Student Aid, commonly known as the FAFSA.

If a student’s financial situation changes — such as by winning an outside scholarship — the federal government has discretion to change its awards. Federal law mandates that any outside scholarship or funds a student earns exceeding their determined need by $300 is considered an “overpayment.”

But when it comes to NU’s institutional dollars — known as a student’s “Northwestern Scholarship” — the University has more flexibility in determining need.

When NU’s aid combined with an outside scholarship exceeds the federal “overpayment” benchmark, a student’s federal funding is the first to go, making the aid package compliant with federal requirements. But NU sometimes takes a step further and dips into a student’s Northwestern Scholarship as well, even though its own aid isn’t subject to federal regulations at that point.

Still, NU often explains changes to financial aid packages by telling students that federal guidelines require it to displace its own aid, emails to students show.

“It is not possible to simply ignore federal qualifying criteria,” University spokesperson Erin Karter told The Daily in a statement.

But, according to experts, private universities like NU can choose whether or not to follow federal determination of need when allocating institutional dollars after federal funds have been removed from aid.

NU denies choosing to reduce its own aid when it’s not federally required to do so, shying away from the term “scholarship displacement.”

“The University does not engage in ‘scholarship displacement,’” Karter wrote in the statement. “A school that engages in this type of practice will reduce their own funding on a dollar-for-dollar basis each time a private scholarship is identified.”

However, The Daily found that NU’s financial aid practices are often identical to those it denies using.

In 2021, when Hill had $20,000 removed from her aid package — which included no federal need-based aid and was therefore not subject to any federal regulation — it came from her “Northwestern Scholarship,” she said.

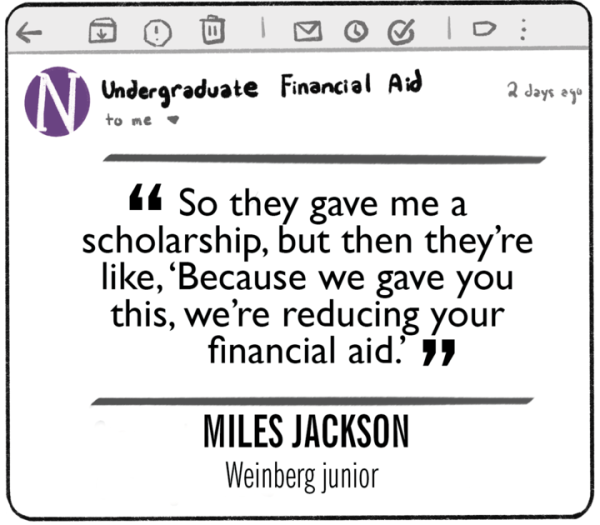

And in January, Weinberg junior Miles Jackson received an email from NU informing him he was a recipient of the C.J. Luther Scholarship for the 2023-24 academic year, an endowed scholarship awarded by NU. The scholarship t

otaled about $55,000.

Similarly to Hill, Jackson’s outside scholarship replaced a portion of his Northwestern Scholarship, according to a University email obtained by The Daily.

“So they gave me a scholarship, but then they’re like, ‘Because we gave you this, we’re reducing your financial aid,’” Jackson said.

Through April, the Office of Undergraduate Financial Aid’s website stated that after the “self-help” — federal work-study opportunities or loans — portion of a student’s award has been replaced, a “Northwestern Scholarship may be reduced, dollar for dollar, for any remaining amount.”

Currently, the website reads almost the same, but without the “dollar for dollar” language. The website also now states that “in some cases where the (College Scholarship Service) Profile contribution is higher than the FAFSA (Student Aid Index), the parent contribution might be replaced.”

Karter said that, in response to The Daily’s request for comment, the Financial Aid Office’s director replaced the “self-help” term on the website with “Federal Work-Study or need-based loan” to make it more clear. However, Karter did not comment on why the “dollar for dollar” language was removed.

“Other universities are bound by these same rules and cannot simply ignore federal requirements,” Karter said. “Like Northwestern though, other schools might show flexibility in their own definition of financial need where that definition differs from the federal definition.”

Under the special circumstances section of the Financial Aid Office’s website, the office says that it makes “every effort to avoid a reduction of a student’s Northwestern Scholarship assistance.”

In some cases, NU does make exceptions for outside scholarship awards.

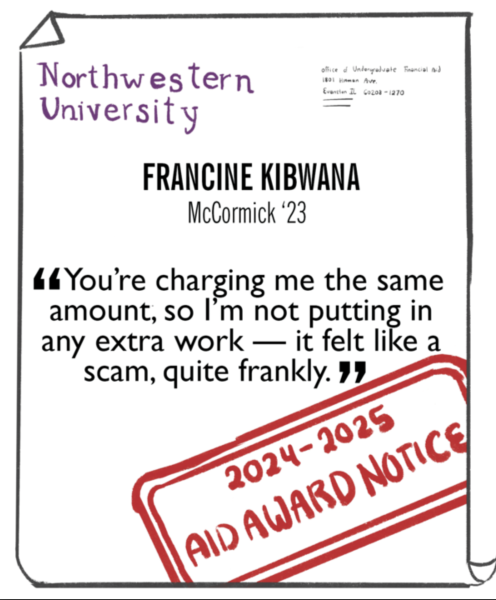

After Francine Kibwana (McCormick ’23) was admitted to NU, she said she was “rigorous” about applying to outside scholarships to offset out-of-pocket costs.

Kibwana won five separate scholarships totaling about $4,000, which she reported and sent to the University. When NU subsequently displaced her outside scholarships, she emailed, called and spoke with employees at the Financial Aid Office.

Kibwana eventually regained the outside scholarships that NU previously displaced.

The office told her that this situation was a “one-time allowance” and encouraged her to “read up on the University’s financial aid policies,” Kibwana said.

But she said her experience in regaining her outside scholarships discouraged her from applying for more during her time at NU.

“I didn’t know if I was going to catch someone on a good day again,” Kibwana said. “You’re charging me the same amount, so I’m not putting in any extra work. It felt like a scam, quite frankly.”

Making up the difference

With a higher-than-expected tuition bill her freshman year, Hill applied to become a Residential Assistant for the next one to lower costs her $20,000-a-year scholarship would have otherwise covered.

Though Hill’s room and board costs were covered by the University, she said the position did not financially benefit her.

“It didn’t change how much I was paying every year for school,” Hill said.

She said she could have benefited more from working an on-campus job at the Henry Crown Sports Pavilion instead of the hours she worked as an RA.

When Hill applied for the position in 2022, RAs were also paid $500 each quarter. During her sophomore year, Hill’s financial aid was adjusted to account for the $500 and was reduced by an amount equivalent to her room and board costs.

“There seems to be nothing that you can do to lower your tuition unless you just find a way to cover it entirely,” Hill said.

Hill intends to graduate early to pay less for her last year of college.

After speaking with other recipients of the $80,000 scholarship she received, Hill said universities’ varying policies have had mixed impacts on their financial aid, especially at institutions that don’t displace students’ outside awards.

“It’s actually really annoying, because some people in my program go to schools where they don’t do that, and they essentially have free college,” Hill said.

Being unable to use scholarship money to offset costs not covered by financial aid has forced some students to work to pay off tuition-related costs out of pocket each academic quarter, in addition to taking full course loads.

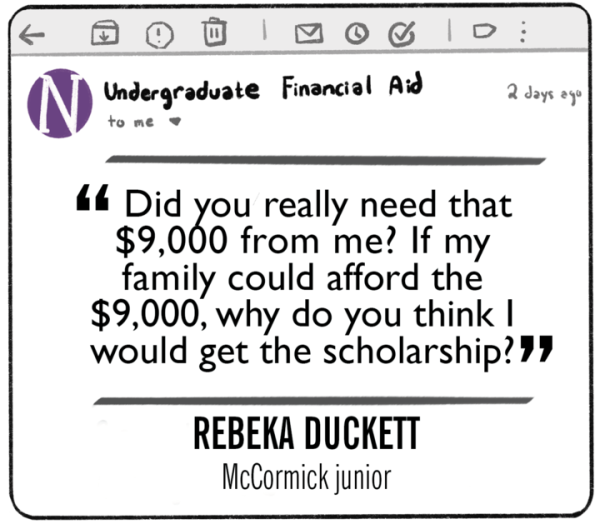

McCormick junior Rebeka Duckett was attending a virtual class for her high school when NU’s financial aid decision arrived in her email inbox.

“I literally just shut my laptop,” Duckett said. “I went on a really long walk in the woods. I sat on a bridge and I just bawled my eyes out, because I was like, ‘Well that’s the end of my dream of coming to Northwestern.’”

NU listed $19,000 as the yearly amount she had to pay, which Duckett said was inflated due to changes in her family’s financial situation. But, after appealing to the University, NU reduced her bill to $9,000, lessening her financial burden.

When choosing to attend NU, Duckett said her plan was to avoid as much debt as possible. She also expected to pay for college out of her own personal pocket.

Throughout her senior year of high school, Duckett had kept a chart of scholarships to apply to, organized by date and provider, and ended up netting about $12,000 through various outside awards. She thought almost all of her additional costs were going to be covered.

“I was ecstatic,” Duckett said. “In my mind, I was thinking, $9,000 out of pocket. My $12,000 will cover that. I’m getting $3,000 extra. I’ll be fine.”

However, in late summer, NU’s Financial Aid Office told Duckett in an email that she needed to report her outside scholarships immediately to the University.

The Financial Aid Office website states that students are required by University policy to notify it about any outside scholarship awards received, even if they are paid directly to students. However, federal law does not require that students report their outside scholarships to their colleges.

Duckett complied with the University’s request, and just months before her freshman year — like Hill — she was notified that the University had cut her aid by nearly the full amount of her outside scholarships, leaving her with a $9,000 bill.

She had saved money from working for three years during high school, but a $9,000 bill left her having to pay $3,000 each quarter out of pocket. This placed an added financial pressure on her to find a job from the moment she arrived at NU.

“It wasn’t because I wanted to,” Duckett said. “It was purely because I was stressed and I was worried about how I’m gonna pay the next quarter off.”

Juggling NU’s challenging mechanical engineering curriculum, a new job and navigating the University for the first time took a toll on Duckett.

“For the first quarter, I was fine. The second quarter I was fine. I just managed to scrape by barely,” Duckett said. “But if you ask anyone who knew me freshman year, I was very broke.”

When she spoke to the Financial Aid Office about the $12,000 in scholarships she had won, Duckett said staffers told her that her family was capable of paying the $9,000 and as a result, they would reduce her need-based aid.

But for many students, there is still a gulf between their demonstrated financial need and what they can actually pay.

“Did you really need that $9,000 from me?” Duckett said. “If my family could afford the $9,000, why do you think I would get the scholarship?”

How universities’ policies vary

The way a university approaches outside aid is largely based on how it calculates a student’s demonstrated need.

When filing for financial aid at NU, students typically submit forms for FAFSA and their CSS Profile. While federal aid must be allotted according to guidelines set by the FAFSA, universities can determine how they award institutional money using any combination of these factors.

As a result, many universities like NU are required to follow federal guidelines when federal money is involved in need-based financial aid packages.

“The University reduces a student’s need-based aid only when it is required to avoid a federal ‘overaward,’” Karter wrote in a statement to The Daily.

But according to James Kaster, the director of Financial Aid at Washington and Lee University, a university’s decision to use a federal evaluation to determine institutional need is not universal.

Like NU, Washington and Lee — a private liberal arts university in Virginia — meets the full demonstrated need of its students. But unlike NU, Washington and Lee only reduces need-based grants by 50% of any outside award or benefit, allowing students to use the other half to cover their family’s expenses.

Kaster said Washington and Lee’s policy on outside scholarships aims to recognize the work students have done for the outside award. Through a fifty-fifty split, students still gain some benefit, he said.

Washington and Lee determines institutional aid packages based on a student’s CSS Profile and family tax returns — not the FAFSA. Kaster added that Washington and Lee’s policy on outside scholarships as it relates to institutional aid is not based on any federal policy regarding need-based awards.

“It’s an institutional policy because these are institutional awards that we’re adjusting,” Kaster said. “We don’t adjust federal awards for outside scholarships.”

Award displacement policies do not vary only by university, but by state as well.

To varying degrees, scholarship displacement is limited or banned in five states: California, Maryland, New Jersey, Pennsylvania, Washington and — soon to be — Minnesota.

In February, Illinois state Rep. Nabeela Syed (D-Palatine) introduced a bill that could help students benefit from both university and non-university scholarships if passed. The Scholarship Displacement Act would also aim to prevent non-university affiliated scholarships from being taken from students.

“I wanted to try to take on this issue because I think scholarship displacement is not necessarily serving young people and serving students that are embarking on this journey in their life,” Syed said.

Currently, the bill focuses primarily on Illinois’ public universities, but Syed said she might revisit private universities as the legislation develops.

Impact on smaller, local scholarships

While students may apply for larger ‘big-batch’ scholarships to cover gaps in financial need, many also apply for smaller local scholarships to take care of expenses outside of tuition.

In 2022, student loan servicer Sallie Mae reported that the average scholarship from a non-profit organization or company was $2,189.

NU’s current policy eats most outside scholarships for students with a demonstrated need.

Before coming to NU, Medill sophomore Atarah Israel was named the Indiana High School Journalist of the Year for 2022 and earned a $1,000 stipend. But, she never touched the check.

The Indiana High School Press Association sent the money directly to NU, which deducted $1,000 from Israel’s financial aid award. While the University covered 100% of their demonstrated financial need and losing the grant was not immediately pressing, Israel said they had planned to use the money they won for other expenses.

“School supplies, a new laptop, clothes,” Israel said. “I was using (my) laptop for some time before then, so it would have been nice to get a new one for college.”

Internal and merit-based institutional awards

Policies of scholarship displacement can sometimes financially penalize students for winning merit-based scholarships, leaving them worse off than if they were not awarded at all.

Colleges and universities can displace need-based internal scholarships and merit-based institutional awards granted by universities in the same way as outside scholarships.

Prior to attending NU, Weinberg freshman Aleksandar Dale applied to the University of Southern California early action and was accepted. He went through a second application process to apply for one of USC’s merit scholarships, which were offered to about 21% of first-year students entering the school in 2023.

Dale was offered a half-tuition Presidential Scholarship for the 2023-24 academic year, worth about $30,000 at the time.

He said he thought funds from the merit scholarship would be added to his demonstrated aid package.

“I was super excited because I’m like, ‘I’m going to get to go and be in California for free’,” Dale said.

That didn’t happen.

Instead, he said when USC recalculated his financial aid to account for the merit scholarship, the university dropped its need-based gifted aid so low that he would end up paying more money to attend USC with the merit scholarship than without it.

“You tell me you want me and you do all these things and you give me the scholarship, and then nothing changes with the scholarship,” Dale said. “I felt like it was just an empty title.”

According to USC’s undergraduate admission website, its merit scholarship and need-based financial aid applications are separate processes. Since Dale did not qualify for a Pell Grant or the California Dream Act, the state’s ban on scholarship displacement did not apply to his situation.

Dale ultimately chose NU because he felt it offered him a better financial aid package.

Some NU students have been financially disadvantaged for earning outside scholarships as well.

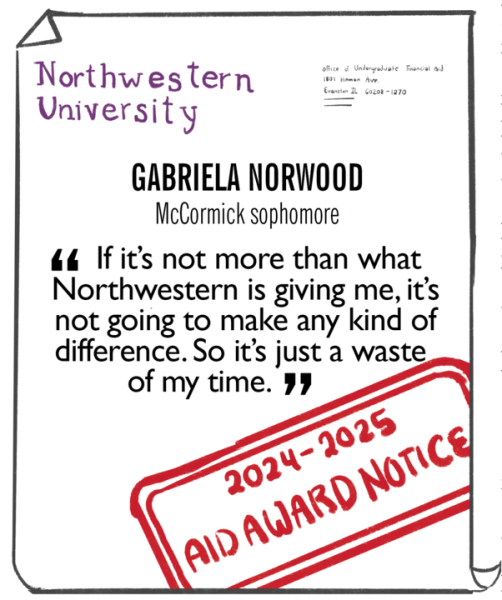

Just before she won a four-year, $40,000 scholarship during her freshman year at NU, McCormick sophomore Gabriela Norwood met with the Financial Aid Office to discuss how her outside award would impact her aid package, including the federal work-study that comprised part of her award.

“They told me, by federal law, they have to take it away, (that) they’re not allowed to give me more than I actually need,” Norwood said of the scholarship.

Norwood had logged work-study hours during her freshman year. But after winning the scholarship, she remembered that the federal work-study component was the first to be excised from her award package, in accordance with federal requirements.

Now, she says it’s tough to find any job on campus, and she can’t rely on work-study dollars to offset her family’s costs.

“Last year, I didn’t max out my work study, but it still helped me,” Norwood said. “And now, I can’t even subtract that amount from what my family is having to pay through work study.”

For an outside scholarship to significantly benefit Norwood, she has to find one that is worth more than what NU is giving her in aid, she said.

But now, she’s not applying to as many outside scholarships.

“If it’s not more than what Northwestern is giving me, it’s not going to make any kind of difference,” she said. “So it’s just a waste of my time.”

Why universities continue award displacement practices

Schools often justify their scholarship displacement policies as a way to “spread the wealth,” according to Danielle Lowry, a researcher at the University of Pittsburgh’s Learning Research & Development Center, who published a paper on scholarship displacement earlier this year.

She said that schools say that displacement allows them to extend their financial resources to more students.

“From their perspective, this student’s receiving all of this outside grant money, so let’s give the aid we would have given to them to another student who needs it,” she said.

NU did not comment about where displaced aid goes after a student wins an outside scholarship.

Still, the University’s policies have left many students disillusioned by NU’s financial aid system.

The total cost of NU for students living on-campus has jumped from $76,317 for the 2020-21 academic year to $89,448 for the upcoming academic year.

Given rising costs, some students with aid packages feel they have few options to pay for expenses that would otherwise be covered by outside scholarships.

“If your scholarship is just money and you can’t get more than your aid, there’s no point,” Hill said.

Email: tunjiosho-williams2025@u.northwestern.edu

Twitter: @osho_olatunji

Related Stories:

— Northwestern to pay $43.5 million in settlement of financial aid lawsuit

— NU undergraduate tuition to increase 4% for the 2023-24 academic year