College students with college debt claim they do not receive adequate online counseling services for taking out federal loans, a problem also affecting some Northwestern students.

Fourty percent of respondents who said they took out federal loans reported they did not receive any online or in-person counseling about the federal loan process, by the National Economic Research Associates.

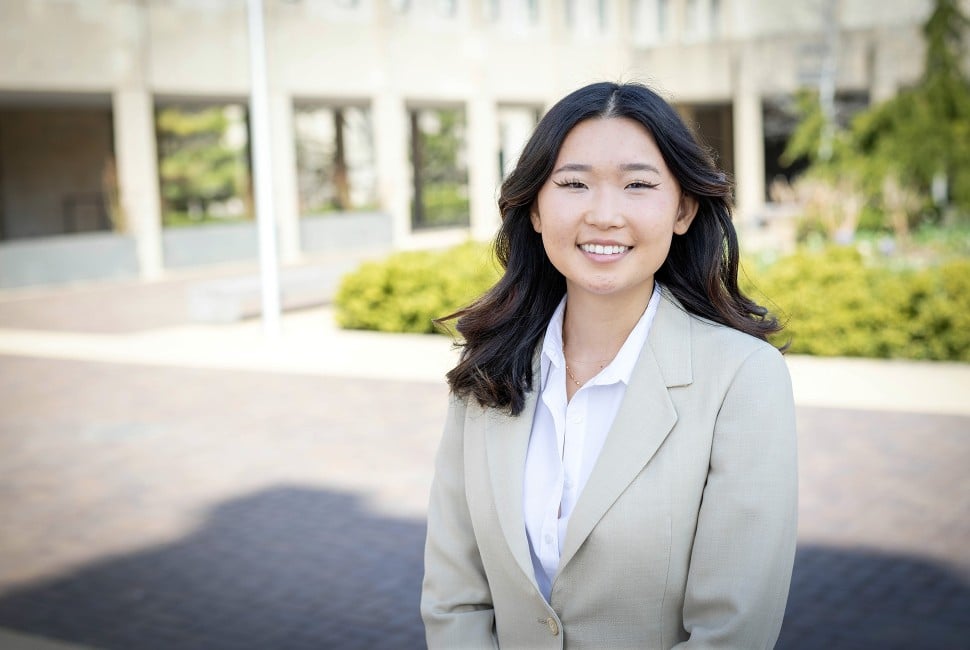

Healey Whitsett, a senior analyst at the economic consulting firm NERA, co-authored the report, titled “Lost without a map: a survey about students navigating the financial aid office.” She said large number of students not receiving financial aid guidance is “the main takeaway” of the report, since colleges are mandated by law to issue some form of counseling or education for students with federal loans.

The report included a survey aimed at “high-debt borrowers,” or those who report receiving higher than average grant aid. The report focused on 13,000 respondents who are current students or recent college graduates. Respondents were asked about the information and education they received when they took out federal loans for financial aid. The survey respondents included students on mailing lists related to student loan interest, Whitsett said.

Whitsett said it is unlikely the respondents did not receive some form of counseling. She said it is possible that the counseling is just not effective or engaging enough for students to remember it.

Whitsett said an online course seems to be the most common education for students with federal loans.

Report co-author Rory O’Sullivan, policy director of Young Invincibles, a nonprofit organization that seeks to improve educational, health and economic opportunity for young adults, said the report demonstrates how confusing applying for financial aid and federal loans can be.

“One of the main things we’ve been hearing from young people across the country is that they have a very difficult time learning about financial aid,” O’Sullivan said. “There is a lot of complexity of the terms and conditions of loans, and it can be a pitfall for young people if they don’t know their best options.”

The survey showed two general trends about loan education, O’Sullivan said. Respondents said they would like more “interactivity” or checking to make sure that students understand the financial aid processes. But O’Sullivan said even that is not enough for students, because many of them reported they would like an in-person mentor to walk them through the process.

Some NU students agree that the financial aid and federal loan processes are difficult to understand. Communication freshman Carolyn Betts described the financial aid process as “ridiculously confusing.”

Betts said she vaguely remembers having a “mix between an online survey and a quiz” that describes the types of loans and how they work after she took out her loans.

“Because it was a requirement, I had to blow through it on my own time,” Betts said. “I feel like the school just does it for legal reasons. It didn’t really help me, it just helps them.”

Though students may express general confusion over the loan process, Brian Drabik, associate director of financial aid at NU, said he has not come across this issue so far. He said every college is required to maintain records of students completing counseling.

NU uses the U.S. Department of Education’s online counseling tool, which is an online tutorial, Drabik said. The tool gives students with federal loans an overview of their rights, and at the end of the tutorial it provides the contact information of a financial aid administrator.

Drabik said the Department of Education “has made great strides to simplify the financial aid process.” Within this past year, when students log in to fill out their FAFSA form, they can authorize IRS data retrieval, which pulls forward a student’s information. This helps prevent students from making errors on the form.