The economy was the top issue for voters in the 2024 presidential election, according to data from the Pew Research Center. In a New York Times survey investigating which candidate voters trusted most to handle the economy, President-elect Donald Trump consistently led Vice President Kamala Harris leading up to the election.

In his campaign, the former president proposed a variety of tax cuts and sweeping tariffs. Trump promised to “end inflation, and make America affordable again” on his website.

Harris’ economic plans included rolling back tax cuts for the rich and increasing the corporate tax rate, rather than imposing wide-reaching tariffs. But like Trump, Harris wanted to lower prices and end taxes on tips.

Trump has said he will implement high tariffs to help pay for the elimination of taxes in several areas, including on Social Security benefits and tips. He said he will impose a 10% to 20% tariff on all goods and at least a 60% tariff on goods from China.

The tax cuts on Social Security and tips are more targeted toward working class Americans, Kellogg Prof. Georgy Egorov said.

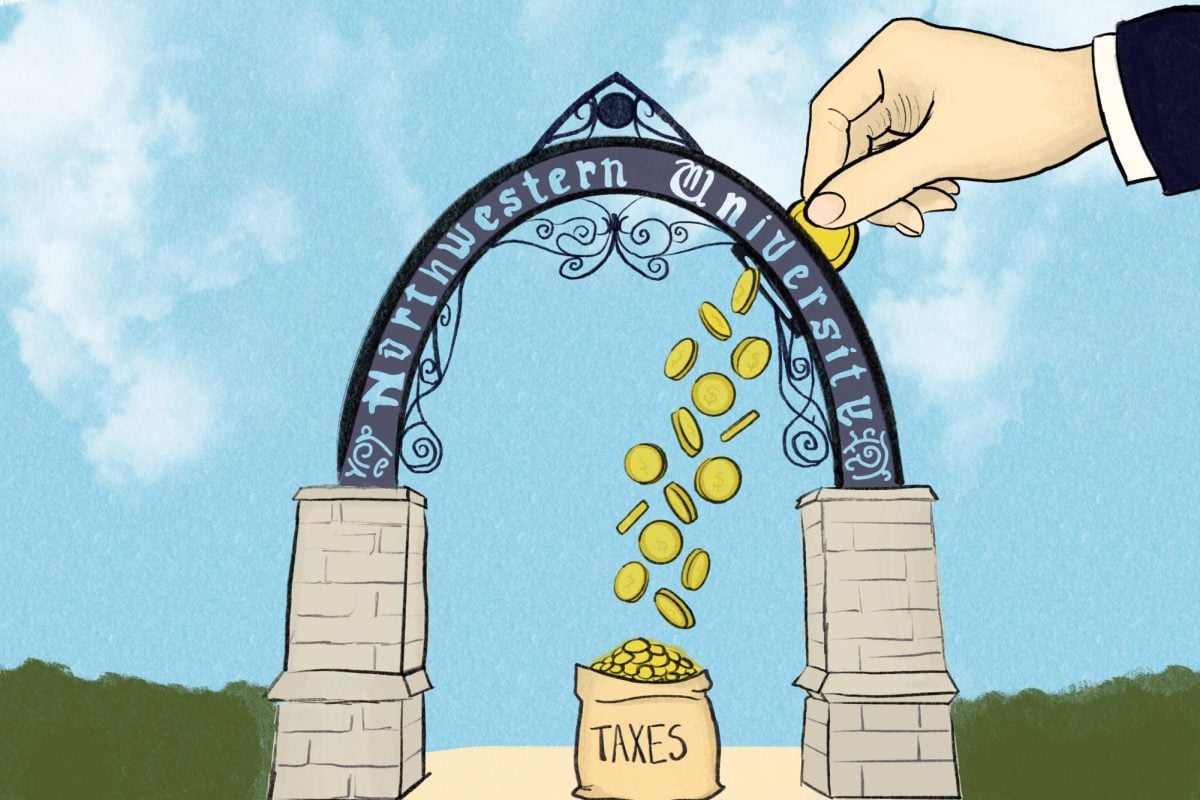

In the long run, Trump’s tax proposals will benefit all Americans — but high-income Americans will reap relatively larger benefits — according to research from the Tax Foundation. Trump has also suggested that he would like to eliminate the federal income tax, which will likely benefit high-income Americans most.

Economics Prof. Larry Christiano explained that the U.S. has a relatively small base of trade for tariffs.

“The spending of the government is so humongous that the ability of the tariff to raise revenues is very tiny,” he said.

He added that revenue from tariffs would be minimal compared to revenue from the federal income tax.

Egorov emphasized that tariffs are more effective when used with a specific intent related to a specific industry or competing country.

“(Using tariffs) as a way to negotiate is probably a reasonable use,” Egorov said. “If one uses tariffs as the ends, not the means — if we impose tariffs because we think the consequences of these tariffs are going to be good for the U.S. as a whole — then it’s probably misguided.”

Implementing tariffs results in more expensive goods for U.S. consumers, economics Prof. Jonas Jin said. Those tariffs may also provoke retaliation from other countries, Jin said.

Jin said these changes aren’t ideal for the future of the U.S. economy or consumers.

“The trade policy is bad, honestly,” Jin said. “It’s going to be rough, especially if trade partners decide that they want to retaliate with tariffs of their own — kind of creating a trade war.”

However, Jin added that he does not foresee a recession and believes the economy will still continue to grow.

Christiano said tariffs are not always the best idea because they will likely result in price increases for consumers.

“When costs go up, then prices go up because prices cover costs,” Christiano said. “A tariff, by definition, raises the costs of firms that export. We can expect that with tariffs on imports, prices will go up.”

Christiano said that it’s not clear which group of consumers will be the most impacted by tariffs. However, he added that people with lower income tend to purchase goods from China, which may cause that group to pay higher prices to accommodate the large tariff proposed by Trump.

Jin said overall, Trump’s proposals for tax cuts and tariffs aren’t compatible with his claims that he will bring prices down and end inflation.

“Ending inflation is impractical and not a good thing either,” Jin said. “I don’t think the policies themselves are conducive to reducing inflation. A tax cut is more likely to lead to more inflation rather than less, and these tariffs are also likely going to lead to an increase in the price of goods.”

Email: celesteeckstein2028@u.northwestern.edu

X: @CelesteEckstein

Related Stories:

— NU faculty experts worry about second Trump presidency in post-election panel

— NU College Republicans repaints The Rock with pro-Trump messaging