‘It’s not a light switch’: Evanston economy buckles amid COVID-19 recession

May 3, 2020

From furloughed employees to cash-strapped owners, COVID-19 closures are hitting Evanston’s economy hard. The city is already suffering from the effects of a coronavirus-induced recession — and its economic hardship, Evanston Economic Development Manager Paul Zalmezak said, has just begun.

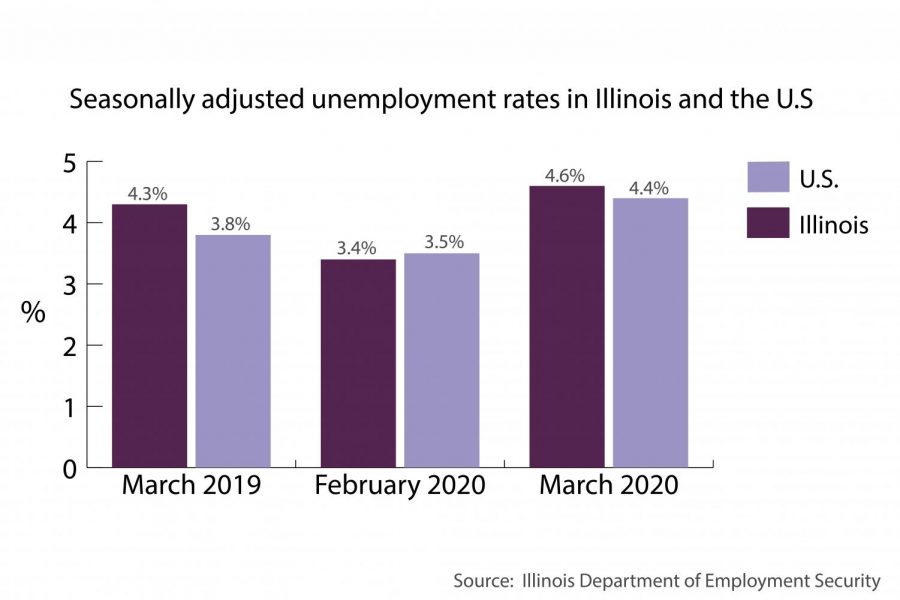

The Illinois Department of Employment Security has processed more than 755,000 initial unemployment claims from March 1 through April 18. At an April 28 City Council meeting, Interim City Manager Erika Storlie estimated the city could lose between $11-20 million in revenue, or 10 to 20 percent of overall revenue.

Property taxes fund most of the city’s budget. But with revenue from taxes on sales; state income; hotel, amusement and liquor; and transportation and parking continuing to decline, Zalmezak said the recession could profoundly alter Evanston’s economic landscape.

“We’re going to see vacancies like we haven’t seen in a long time,” Zalmezak said. “Those businesses that were struggling right before this are probably not going to reopen.”

[Read more about challenges local businesses faced before the pandemic]

Amid closures, small businesses struggle

Like most small business owners, Kenny Chou was depending on the Paycheck Protection Program loan to keep his local restaurant, Table to Stix Ramen, afloat.

Established by the CARES Act, the forgivable, federally backed loan would have guaranteed Chou loans for eight weeks of payroll and other costs, helping his business remain viable and his staff pay their bills.

But while publicly traded companies qualified for loans in the millions, Table to Stix didn’t receive a penny of the $349 billion relief program. Since Gov. J.B. Pritzker announced a shelter in place order March 20, Chou said business has been down 80 percent.

“We didn’t really expect things to be this bad,” he said. “Unlike big corporations, us small business owners don’t have a large cash reserve. The strongest will survive and the weak will have to eventually close down.”

A city survey found only 6 percent of Evanston businesses obtained funding in the first round of PPP emergency funding.

As Evanston residents endure personal economic hardship, Evanston businesses — most of which employ around 25 people, Zalmezak said — will see fewer customers. Despite some stores and restaurants shifting to takeout and delivery, Zalmezak said most are operating at 30 percent of their peak revenue.

“That’s beyond recession terms,” he said. “That’s devastating.”

The over 8,000 undergraduate students that attend Northwestern are also Evanston shoppers. For businesses relying on take-out or online orders, campus closures have eliminated a significant portion of their clientele.

Operating via Grubhub and curbside pick-up, Bennison’s Bakery only allows six to seven customers into the store at a time. Business is down 15 percent, but owner Jory Downer said payroll costs are lower with employees working fewer hours.

Evanston’s businesses are likely to bear the burden of a recession in unequal ways, Northwestern professor Bruce Carruthers said. Carruthers, a sociologist of economy and law, said wealthier lakefront areas are better positioned to endure declining income and shuttered shops than the city’s west and southwest neighborhoods.

With hotel occupancy rates plummeting and some restaurants choosing to close their doors, Carruthers said he predicts Downtown Evanston will look different when students return to campus.

“The commercial landscape of downtown Evanston is going to be remade,” Carruthers said. “Maybe some of your favorite restaurants will be gone, or the bars will have disappeared. You may have to get used to some new commercial activity.”

The road to recovery

Small businesses and large employers aren’t the only entities the recession will jeopardize: Evanston also placed a hiring freeze on all nonessential city employees and laid off eight full-time, non-union employees and Parks and Recreation part-time employees.

In an interview with The Daily, Mayor Steve Hagerty said the city is in a “good financial position” to respond to the COVID-19, but is concerned about the “financial calamity in front of us.” Storlie said at Monday’s council meeting city staff predicted a level of recovery by mid- to late-summer. But if stay-at-home orders continue into June, the financial damage could be more significant. Storlie also said the budget impact is expected to extend into 2021 and beyond.

To provide businesses with immediate relief, the city is partnering with Lending for Evanston and Northwestern Development, a Northwestern student-run microfinance organization. With the help of LEND, $100,000 of the city’s budgeted funds for workforce development will be redistributed primarily to women- and minority-owned businesses, Zalmezak said.

Additionally, the city is eliminating nonpayment penalties for certain bills, including water, sewer and sanitation bills; parking and compliance citations; liquor taxes; and amusement taxes.

But due financial regulations, Zalmezak said Evanston is especially reliant on state and federal relief efforts like the CARES Act. He added that the economy won’t return to normal “like a light switch.”

“We have a limited ability to provide any kind of financial assistance because we’re in a tight bid for services that we provide to the community,” he said. “Like the federal government does, we can’t print money. So we’re really limited in what we can do financially.”

Even if businesses fully recover, which Zalmezak imagines will only happen after scientists develop a vaccine, they likely won’t operate at peak sales. He’s working with the Mayor’s COVID-19 Task Force to develop heath guidelines for businesses during and after a pandemic. Those guidelines may include limits on the number of in-store customers, fewer tables, plastic shields at counters and disposable utensils.

Chou, the owner of Table to Stix, echoed Zalmezak’s skepticism. The restaurant has cut unnecessary expenses and hours of operation, he said, but business going forward looks uncertain.

“Unless there is a definite treatment or a vaccine for COVID-19, I don’t see things going back to normal anytime soon,” Chou said. “Basically, we work a day to live a day.”

The story was updated with additional comments from Steve Hagerty.

Email: [email protected]

Twitter: @herscowitz