Northwestern sees modest endowment growth for 2012

Northwestern’s endowment grew slightly in fiscal year 2012, following a national trend. NU has the 10th-highest endowment nationwide.

February 13, 2013

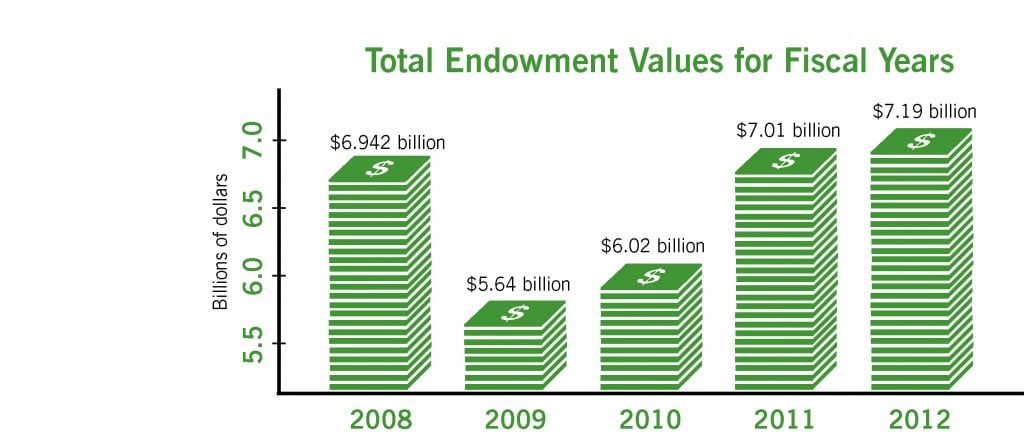

Northwestern’s endowment growth rate decreased by about 14 percentage points from the 2011 fiscal year to the 2012 fiscal year, according to the University’s Investment Office.

The rate dropped from 16.7 percent in the 2011 fiscal year to 2.7 percent in the 2012 fiscal year.

The University’s growth rate decrease follows a national trend of relatively small university endowment changes across the nation. The National Association of College and University Business Officers found in their annual report, released Feb. 4, that on average, college endowments declined 0.3 percent during the 2012 fiscal year after an average increase of 19.2 percent in 2011. The association ranked NU as having the 10th-largest endowment.

“I think every school kind of follows the market,” said Will McLean, NU’s chief investment officer. “When we have a great year, we don’t spend more because you are going to have a year like last year where it’s kind of flat.”

For the 2012 fiscal year, which spanned from September 2011 to August 2012, the NU endowment grew from about $7 billion to $7.19 billion — a growth rate of about 2.7 percent. During the previous fiscal year, the endowment grew about 16.7 percent, from about $6 billion to about $7 billion.

McLean said part of the decrease came from the instability of the European markets over the last fiscal year. NU and many other universities received lower returns on their investments in Europe.

Overall investment returns also decreased, dropping from 18.3 percent in the 2011 fiscal year to 5.2 percent in 2012.

Still, McLean said NU should not notice any changes due to the smaller growth rate. The University spends consistently about 5 percent of the endowment each year, no matter what kind of return it gets, anticipating fluctuation in endowment growth. He also noted things had already started to pick up for the start of the 2013 fiscal year.

“The second half of 2012 was better, and we started off strong in January,” he said. “If everything is working well, the endowment is there supporting you and you don’t even notice it.”

These endowment values reflect the net effect of investment gains or losses, gifts from donors and withdrawals for University spending.

Robert McQuinn, the University’s vice president for alumni relations and development, said the proportion of alumni that contribute to the University has stayed fairly constant at about 28 to 30 percent over the last few years. He said these rates have declined for peer institutions.

Donations and gifts from alumni and other sources increased from $221 million in 2011 to $292 million in 2012, he said.

“In fact, it was the second biggest year in the history of the University,” McQuinn said. “That was a very positive sign.”

The amount entering the endowment fund during 2012 increased as well, from $60.9 million in 2011 to $77.8 million.

According to the college and business association’s report, NU has the 10th largest endowment, dropping from a 9th-place ranking in the 2011 fiscal year. Harvard University topped the list with a current endowment of about $30.4 billion.

However, all of the National Association of College and University Business Officers’ numbers are based on a fiscal year that runs from July 1 2011 to June 31 2012. NU’s fiscal year starts Sept. 1 and ends August 31. The University calculates June fiscal year statistics but officially uses its August numbers.

According to the report’s statistics from the fiscal year ending June 30, 2012, NU’s endowment shrunk by 0.9 percent, but using the more recent August numbers shows a 2.7 percent increase.

As part of his role as Associated Student Government vice president for sustainability, Mark Silberg works for the Northwestern University Responsible Endowment Coalition. He said he was not surprised by the strong alumni support but acknowledged although NU has great financial leaders, the University is victim to the market just like everyone else.

“Everyone loves to contribute to the alma mater,” the Weinberg junior said. “There’s something that we cannot guarantee and that’s a return on our endowment.”

For a larger version of the graphic in this story, click here.